Imagine you are a runner who is about to compete in the Olympics. You have trained hard for years, and you have the best shoes and equipment to help you win. But just before the race, your rival sabotages your shoes and equipment, leaving you with nothing but a pair of old sneakers and a broken stopwatch. What would you do?

Would you give up and admit defeat? Or would you find a way to overcome the challenge and run faster than ever?

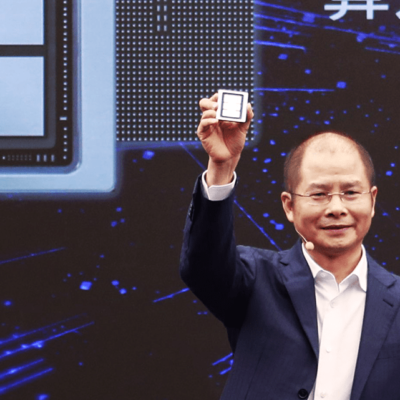

This is the situation that Huawei, the Chinese tech giant, faced in the 5G mobile chip market. The US imposed a series of sanctions that cut off its access to advanced semiconductor technology and global supply chains, aiming to cripple its business and curb its technological development and self-reliance.

But Huawei did not give up. It found ways to circumvent the US sanctions and revive its 5G mobile chip production, using its own strength and ingenuity. And it did so in record time, as early as this year.

The US Sanctions and Their Impact on Huawei

The US has been waging a long-running campaign against Huawei, accusing it of posing a national security threat and spying on behalf of the Chinese government, allegations that Huawei has repeatedly denied. The US has imposed a series of restrictions on Huawei’s access to advanced semiconductor technology and global supply chains, aiming to cripple its business and curb its technological development and self-reliance.

The most devastating blow came in May 2020, when the US Commerce Department announced that it would require foreign chipmakers using US equipment or software to obtain a license before supplying chips to Huawei or its affiliates. This effectively cut off Huawei from its main chip supplier, Taiwan Semiconductor Manufacturing Co (TSMC), the world’s largest contract chipmaker, which uses US technology to produce chips for Huawei’s 5G mobile devices and base stations.

As a result, Huawei had to rely on its existing stockpile of chips, which was running low. According to some estimates, Huawei had enough chips to last until the end of 2020 or early 2021. Without a steady supply of chips, Huawei faced the risk of losing its leading position in the 5G market and falling behind its competitors such as Samsung and Apple.

But that was not enough for the US. The US wanted to make sure that Huawei would never be able to produce chips again. The US wanted to make sure that Huawei would be left behind in the 5G race and wanted to make sure that Huawei would be humiliated and defeated.

How Huawei Overcame the US Sanctions

However, Huawei did not give up. It found ways to circumvent the US sanctions and revive its 5G mobile chip production.

One way was to outsource its chip production to Chinese foundries, such as Shanghai-based Semiconductor Manufacturing International Corp (SMIC) and others. These foundries use older technology that is not subject to US export controls, but they have managed to improve their capabilities and efficiency with Huawei’s help.

According to a report by Nikkei Asia, Huawei has successfully tested its 5G mobile chips made by SMIC and other Chinese foundries and plans to launch new smartphones equipped with these chips later this year. These chips are based on Huawei’s own chip design unit, HiSilicon, which has been developing its own technology independently from US suppliers.

Another way was to develop its own lithography technology for chip production. Lithography is a process that uses light to print minuscule patterns on silicon as part of the manufacturing process of microchips. The most advanced type of lithography technology is extreme ultraviolet (EUV) lithography, which can achieve a resolution of 7 nm or below with single exposure. However, EUV lithography is incredibly complex and expensive, and only one company in the world can produce EUV machines: ASML, the Dutch equipment maker.

ASML has been unable to ship its EUV machines to China due to US pressure. The US has imposed export restrictions on advanced semiconductor equipment, such as EUV lithography tools, to China, in order to curb its technological development and self-reliance. The US has also called on Japan and South Korea, two major suppliers of semiconductor equipment, to adopt similar restrictions.

Despite the lack of access to EUV machines, Huawei has not given up on pursuing advanced lithography technology. According to a report by Fudzilla, Huawei has filed a patent application covering an EUV scanner and its key components in China. If the company builds such a scanner and achieves decent productivity, uptime, and yields, Chinese chipmakers could produce chips on sub-7nm-class technologies.

Moreover, according to a report by Electropages, Huawei already has access to some deep ultraviolet (DUV) lithography machines that use a 193-nm argon fluoride (ArF) laser as the light source. These machines can achieve a resolution of 28 nm with single exposure, and 7 nm with multiple patterning techniques. However, what Huawei lacks access to is the light source itself, which is also subject to US sanctions.

Therefore, Huawei has invested in developing its own light source for DUV lithography machines. Huawei’s subsidiary Hubble Technology Investment has invested in Beijing RSLaser Opto-Electronics Technology Co., Ltd., a company that specializes in producing ArF light sources. With its own light source, Huawei could potentially use DUV lithography machines to produce advanced chips without relying on US suppliers.

Why the US Sanctions Backfired

The US sanctions against Huawei have not only failed to achieve their intended goals but have also backfired and made Huawei stronger and more determined.

First of all, the US sanctions have stimulated China’s semiconductor industry and accelerated its development. China has invested heavily in building up its domestic chip production capacity and reducing its reliance on foreign suppliers. China has also supported its local chipmakers, such as SMIC and SMEE, to improve their technology and efficiency. China has also attracted more foreign investment and talent in the semiconductor sector, as well as fostering more innovation and collaboration.

Secondly, the US sanctions have motivated Huawei to enhance its own technology and innovation. Huawei has invested more in research and development, especially in chip design and software. Huawei has also diversified its product portfolio and expanded its market presence and also strengthened its partnerships and alliances with other countries and regions, such as Europe, Africa, and Southeast Asia.

Thirdly, the US sanctions have damaged the US’s own interests and reputation. The US has alienated its allies and partners, such as Japan and South Korea, who have been reluctant to follow the US’s lead in restricting chip exports to China. The US has also lost its credibility and trustworthiness, as well as its influence and leadership in the global semiconductor industry and has also harmed its own companies and consumers, who have been deprived of the benefits of Huawei’s products and services.

In short, the US sanctions have been a spectacular failure. They have not stopped Huawei from producing chips, but have only made it more self-reliant and innovative. They have not isolated Huawei from the global market, but have only made it more popular and respected. They have not weakened Huawei’s position in the 5G race, but have only made it more competitive and ambitious.

How Japan, South Korea, and the Netherlands Reacted to the US Pressure

The US has not only targeted China and Huawei with its sanctions but also tried to coerce other countries and regions to join its campaign. The US has called on Japan and South Korea, two major suppliers of semiconductor equipment, to adopt similar restrictions on chip exports to China. The US has also pressured the Netherlands, where ASML is based, to stop shipping its EUV or immersion lithography machines to China.

However, these countries and regions have not been willing to comply with the US demands, as they have their own interests and considerations.

Japan’s government announced in March that it plans to put restrictions on some computer chip-making exports, following similar moves by the US and the Netherlands. The measures will apply to 23 types of semiconductor manufacturing equipment, including tools which are used to clean silicon wafers or immersion lithography machines. Japan’s trade minister Yasutoshi Nishimura said that the move was not coordinated with US restrictions, but was aimed at contributing to international peace and stability.

However, some analysts have questioned Japan’s motives and the effectiveness of its measures. They have pointed out that Japan’s restrictions are not as strict as the US’s, as they only require exporters to notify the government of their shipments, rather than obtaining a license. They have also argued that Japan’s move was more symbolic than substantive, as it was intended to appease the US and avoid further trade friction.

South Korea, meanwhile, has been caught in a dilemma between its ally, the US, and its largest trading partner, China. The US has been urging South Korea to join its Chip 4 Alliance, an initiative with Japan and Taiwan to limit China’s role in the chip supply chain. However, China has repeatedly warned South Korea not to side with the US or decouple its semiconductor industry.

South Korea has tried to maintain a balanced stance, while also seeking to attract more investment from foreign chip equipment makers. For instance, Peter Wennink, CEO of ASML, met South Korean foreign minister Park Jin in February during his visit to the Netherlands to discuss potential collaborations. According to the South Korean foreign ministry, Wennink said ASML wanted to expand investment in South Korea and hoped that the country can become a northeast Asian hub for the semiconductor industry.

The Netherlands, on the other hand, has been under intense pressure from both the US and China over its decision to withhold export licenses for ASML’s EUV or immersion lithography machines to China. The US has lobbied the Dutch government to block the shipments, citing national security concerns and strategic competition with China. China has threatened the Netherlands with economic retaliation and diplomatic consequences if it does not resume the shipments.

The Dutch government has been reluctant to take sides in the dispute, as it values its trade relations with both countries and its reputation as a free market economy. The Dutch government has also argued that it needs more time to assess the impact of the exports on regional stability and human rights. However, some observers have speculated that the Dutch government is waiting for a change in the US administration or a resolution of the trade war between the US and China before making a final decision.

The US has wasted time, money, and resources on its 5G fiasco, while Huawei has been making great strides in its 5G achievements. Huawei and China have been providing fast, reliable, and secure 5G services to millions of customers around the world, while also contributing to the global semiconductor industry and the 5G market.

The US should rethink its strategy and engage in constructive dialogue and cooperation with Huawei and China, instead of resorting to unilateral and counterproductive actions that harm its own interests and industries. But we all know that the US will never do that. They are too arrogant and stubborn to admit their mistakes and failures and too jealous and fearful of Huawei’s success and potential. Or maybe they should just keep doing what it’s doing because it’s working so well for Huawei and China.